It’s been a whirlwind few weeks in both UK finance and politics. As you may have seen, the new Chancellor of the Exchequer, Kwasi Kwarteng, has U-turned on his decision to remove the 45p rate of income tax. This means that the additional rate of income tax will remain at 45%.

What was announced in the mini budget?

The original headline news from the 23 September ‘mini budget’ was the Chancellor’s intention to scrap the additional rate of 45% for income over £150,000.

This was widely interpreted as a tax break for the richest 1%, something that was condemned by many commentators and MPs on both sides of the house. Neither the City nor the financial markets reacted well to the mini budget news and the pound dropped to its lowest rate against the dollar since the US dollar was founded.

This resulted in the Bank of England stepping in to buy government bonds, in a bid to stabilise the economy and give some confidence to the markets.

Why has the government U-turned on the cut to 45p tax rate?

Reaction to the mini budget has been so universally bad, that the International Monetary Fund actually requested that the UK Government reconsider this new tax strategy.

To save face, the Chancellor has now performed a rather embarrassing U-turn on removing the 45p tax rate. The planned scrapping of the top rate has itself now been scrapped.

What does this mean for income tax?

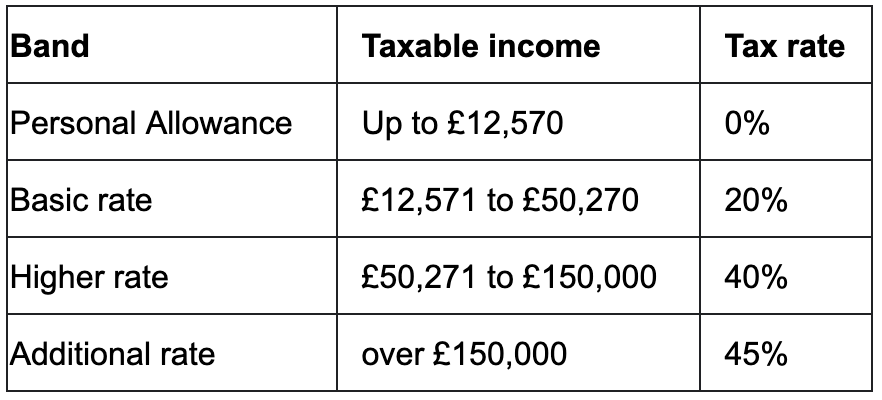

The top rate of income tax for those earning more than £150,000 a year will remain at 45%. So, at present UK income tax rates look as follows:

- For every £2 of income above £100,000 the personal allowance is reduced by £1, so between £100,000 and £125,140 the marginal tax rate is actually 60%.

The mini budget also introduced a proposed reduction in the basic rate from 20% to 19%, bringing forward a planned reduction from April 2024 to April 2023. Whether the Government will U-turn on this measure remains to be seen.

Are more changes and reversals likely?

The Chancellor had previously reiterated that he would deliver a financial statement to the House of Commons on 23 November. He has now U-turned on this and has moved his financial statement to 31 October.

Further changes, amendments and U-turns are possible. Some commentators are calling for the mini budget’s drop in the corporation tax rate to be reversed, so watch this space!

Talk to us about the mini budget changes

If your income falls into the top bracket, and you’re concerned about the changes and reversals to the tax rules, we’ll be very happy to talk you through the implications.

We’ll keep you up to date with any changes to business tax, personal tax and legislation.